INDIA'S POSITION IN MANUCFACTURING GOODS WORLDWIDE

Many think that in the aftermath of the pandemic, several manufacturing companies operating from China will relocate their businesses to other destinations, including India.

Many American, Japanese, and South Korean companies based in China have initiated discussions with the Indian government to relocate their plants to India. Companies are expected to exit China due to three primary reasons.

The first is the realisation that relying heavily on China for building capacities and sourcing manufacturing goods is not an ideal business strategy due to supply chain disruptions in the country caused by COVID19.

The second is the fear of Chinese dominance over the supply of essential industrial goods.

The third is the growing risk and uncertainty involved in operating from or dealing with China in the light of geopolitical and trade conflicts between China and other countries, particularly the U.S. Prime Minister Narendra Modi’s emphasis on using the COVID19 crisis as an opportunity to pursue the goal of a selfreliant India must be viewed against this background.

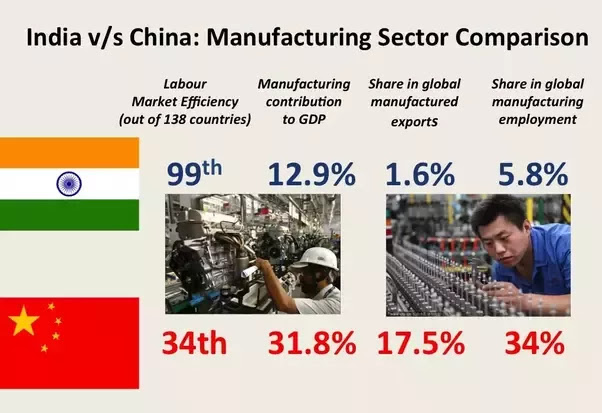

India lags far behind China in manufacturing prowess.China ranks first in contribution to world manufacturing output, while India ranks sixth. Against India’s target of pulling up the share of manufacturing in Gross Domestic Product (GDP) to 25% by 2022, its share stood at 15% in 2018, only half of China’s figure. Industry value added grew at an average annual rate of 10.68% since China opened up its economy in 1978. In contrast, against the target of 12%, the manufacturing sector has grown at 7% after India opened up its economy. Next to the European Union, China was the largest exporter of manufactured goods in 2018, with an 18% world share. India is not part of the top 10 exporters who accounted for 83% of world manufacturing exports in 2018.

For more watch our videos on YOUTUBE

CHANNEL NAMED AS : THE FACT BEE

LINK: https://www.youtube.com/channel/UCPJmVqLO2NyQpm4C7oRjxiw

Comments

Post a Comment